The Bank of Canada raised its overnight rate to 1.0 percent on Wednesday, September 6, 2017, up 25 basis points from 0.75 percent in mid-July. The overnight rate serves as a benchmark that banks and other financial institutions use to set their own interest rates for products such as consumer loans and mortgages.

While this is still an extremely low rate, this is the third increase that the Bank of Canada has made this year and analysts are forecasting a further increase by the end of the year as Canada’s economy continues to grow more broadly and become self-sustaining. The next scheduled date for the Bank of Canada to announce its overnight rate target is October 25, 2017.

What does this mean for mortgage rates?

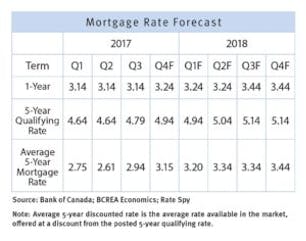

Based on this increase from the Bank of Canada, The BC Real Estate Association (BCREA), upgraded its mortgage rate forecast stating, “…our projected rise in interest rates has occurred and accelerated.” In its Mortgage Rate Forecast for September 2017, the BCREA forecasts that a 5-year fixed mortgage rate offered by lenders will increase to an average 3.15 percent over the fourth quarter, eventually rising to 3.44 percent by the end of 2018.

The posted 5-year qualifying rate is forecast to reach 5.14 percent by the end of 2018.